With rising costs in user acquisition and changes in privacy regulations, not to mention redundancies that have spread across our industry this past year, tackling today’s gaming market can be difficult.

Because of these difficulties, many studios have felt the need to deeply assess their plan for success and growth as we head into a new year. Part of securing future success may lie in understanding and tapping into the potential of emerging markets – one of which is the African games market.

Last month, we shared a post from senior UA and admonetisation manager at Carry1st, Claire Rozain, who touched on Africa’s gaming market and its projected growth. Now, Rozain takes a deeper dive to speak about cracking the African market for F2P games.

The growth of the African market presents new opportunities to reach gaming’s expanding audience, and it has become more critical for marketers to deepen their expertise in this market to make the best use of their investment and get some growth with hyper-localised experience and inclusive game design and ads. This requires a new focus on latency, low-hand devices, hyperlocal experiences, specific game genres, organic growth, and connection.

With 54 countries, 1 billion people, and 650 million mobile users in Africa (surpassing Europe and the United States), Africa is, without a doubt, the new place all marketers need to crack. Marketers and the gaming industry have long overlooked the African gaming market, but it is now a key market for many top publishers, whether focusing on South Africa or North Africa.

But how can you crack the Continent?

Get to know the market: The African Continent gets opportunities to get x2 CPI <> LTV

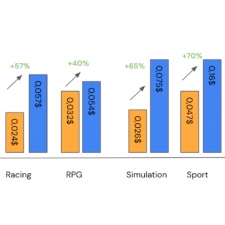

According to Benchmark+, in 2021, the opportunity to make a profit in Africa was already massive

Africa:

- Racing and sports games have the highest ARPPU, circa 20$

- Sport, Strategy and RPG games have the highest ARPDAU from 0,10$ to 0,26$

- Sport, RPG get the highest CPI circa 0,04$

- Puzzle, Simulation, and Racing games have the highest appeal and CTR +6%

While the ARPU and ARPPU are really high on Sport and Strategy games, the CPI remains one of the most expensive. However, the most significant opportunities stay in sports, Simulation, RPG, and racing games. There are massive opportunities to get up to x2 CPI with the ARPDAU in Africa, especially with new payment solutions such as Pay1st allowing to unlock IAPs on the Continent.

If we take racing games right now, according to the research industry network, the global racing games market size was valued at $189,000 million in 2022 and is expected to expand at a CAGR of 8.0% during the forecast period, reaching $299,852.5 million by 2028. On top of that, the massive growth of Africa and its one billion users is a real opportunity for developers.

Finding the right game genre and bringing the right content to the Continent is key to attracting communities and making a profit.

Focus on the Hyperlocal approach

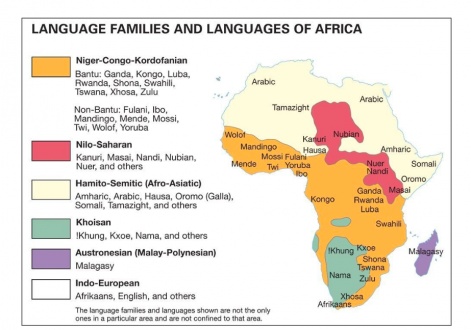

Geographically, Africa is as large as China, Europe, India, and the United States combined. With its 54 countries and over 3000 native languages, The African market remains one of the most underexplored regions globally regarding scaling profitability. Yet, it represents one of the last pockets of growth for the industry.

The Continent is fragmented between different audiences, languages, accessibility challenges, distribution channels and payment solutions – but the African market still represents 1B people keen to play games, who have one of the highest casual game playtime across the entire planet, according to Adjoe.

In order to scale on the Continent, you first need to understand which countries you want to focus on and then develop a laser-focused hyper-local strategy with high k-factor potential in order to scale. For instance, you can see an example of content developed by Carry1st while scaling the top of the chart Carry1st Trivia.

Focus on accessibility

Not long ago – Playing a f2p game would have been a real challenge in some cities like Lagos, Nigeria, known for its challenging mobile coverage. However – thanks to the region’s strong development – f2p games now have an opportunity to scale with Accessibility products.

Nokia states the North Africa region is mainly dominated by 4G networks, and efforts are being made to increase 5G footprints across the region. However – playing a game like Pokemon Go can still remain a challenge on a low-hand device with a 2/3G connection.

According to Bloomberg News, internet providers have committed to 3G coverage in 90 per cent of the country and are starting a fibre network roll-out in six cities in Nigeria. However, the actual game specification can remain a challenge.

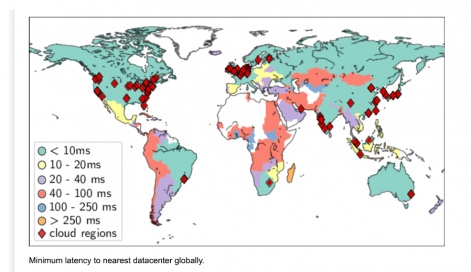

While latency has also been a significant challenge for the publisher, it is key to penetrating emerging markets and getting the most out of the Continent’s growth. Latency represents the duration it takes for a server to respond to a player’s request, typically occurring when a player interacts with the game client server scalability. Having a publisher to assist you in surmounting those challenges, such as Carry1st, allows you to overcome those latency challenges.

To conclude

Africa is the most exciting market to crack – however, there are many specificities advertisers need to understand in order to crack and access this incremental growth. This includes bringing the right content to the Continent, focusing on accessibility and payment unlocking IAPs as Pay1st, accessing hyper-local communities as Tribe and developing a regional knowledge of the Continent!

Edited by Paige Cook