Although the ongoing conflict in Ukraine has seen game developers there facing significant challenges, Ukraine’s gaming industry has also proven incredibly resilient and able to succeed despite the current circumstances.

While some of the Ukraine gaming industry has managed to find growth despite the war, others are still adjusting. Back at DevCom, a panel discussion was given on how the war is impacting the Ukrainian games industry, and now, in this guest post, Katya Sabirova, Head of Communications at Values Value & InGameJob, follows up on the discussion to analyse the facts and numbers centred around the games industry in Ukraine and sharing panelists opinions.

In August, as part of the DevCom conference in Cologne, a panel discussion titled “Unpaused: The Ukrainian Games Industry in Times of War” was held. It featured representatives from various Ukrainian game businesses, including product companies and conference organisers.

In this article, we will take an updated look at this important topic by discussing the Ukrainian video games industry in numbers and facts with key figures from the Ukrainian games industry.

“One goal of the panel discussion was to keep Ukraine at the centre of industry dialogue and remind the international gaming community that the war is not over yet, directly affecting people they know. We also wanted to show how we’ve adapted to these challenges and how the crisis became a driver of success, making us stronger, more resilient, more creative, and – most importantly – more united. We concluded the panel with our hopes for the future, and the response from the audience was overwhelmingly positive”. – Olena Lobova, Founder / Business Development Director, GDBAY

Problems faced by the Ukrainian gamedev market during the first year of the full-scale war:

- Outsourcing companies faced the most significant challenges: losing their global clients because of uncertainty.

- Many companies relocated their teams from Ukraine and set up EU offices for employment.

- Publishers terminated partnerships with Russian and Belarusian companies.

- Numerous game releases were postponed.

- Projects and hiring came to a standstill.

- Mass layoffs.

- Ultimately, foreign companies no longer considered Ukraine a viable labour market due to concerns about reliability, the war, blackouts, and more.

The state of play for investments:

- Investments were completely frozen.

- Some Ukrainian venture funds withdrew their offers and put many deals on hold.

- The absence of systematic support from the government and international institutions played a role in this investment freeze.

“Ukraine’s game development industry has been nothing short of a rollercoaster over the past 1.5 years. Yet, here we stand, not just surviving but thriving, with the power to donate and support our nation’s causes. I hope for more international partners to recognise the amazing talents we’ve got here and engage with our companies, as, throughout this time, we have proved that not only we are strong, but very dedicated and focused”. – Olga Khomenko, COO/Co-Founder, PlayToMax

The current state of the Ukrainian gamedev market:

- Growth of outsourcing companies.

According to DOU analytics, among the top 25 companies in both the purely Ukrainian and international ones that maintain representative offices in Ukraine and pay taxes locally (excluding those involved in gambling, the creation of mobile applications for casinos and social casino games, and excluding 4A Games and AAA Game Art Studio due to missing employee data), only five companies have hired more than ten specialists in 2023.

Interestingly, all of these companies are in the outsourcing sector. Specifically, they are Room 8 Group, Pingle Game Studio, Innovecs Games, Stepico Games, and N-iX Game & VR Studio. The most noteworthy growth has been observed in Room 8 Group, which includes Room 8 Studio and Dragon’s Lake Entertainment. Companies with fewer than 80 employees were not included in this ranking.

- Challenges in securing new contracts have led to downsizing and layoffs within the industry.

During the winter, Kevuru Games observed that some international clients grew cautious about entering into long-term contracts due to the energy crisis. Even before this, another outsourcing company, iLogos Game Studios, encountered difficulties attracting new clients and had to implement employee layoffs.

Market reports indicate that these downsizing trends intensified in the spring of 2023. Additionally, voluntary resignations have occurred due to prolonged inactivity or dissatisfaction with the quality of new projects.

“I feel that the situation for Ukrainian startups is very tough now. I had a strong feeling that many international companies are trying to avoid working with Ukrainian companies, and their sympathy is only on a personal level”. – Iryna S’omka, Director of Business Development/ Partner, Games Gathering

- Projects and hiring have come to a halt.

For instance, Playtika, a company with operations in Ukraine and offices in Kyiv, Dnipro, and Vinnytsia, has decided not to launch or develop new games until the market situation improves. Instead, they plan to focus on investing in studios with high potential. This change in strategy was announced in their fourth-quarter 2022 report.

- Companies severed ties with Russia and Belarus.

- Plarium closed down its studio in Krasnodar.

- Ubisoft halted its business operations in Russia.

- Wargaming shifted its games business in Russia and Belarus to the Lesta studio.

- Gunzilla Games, previously associated with a Russian investor, ceased cooperation with them.

- Seventeen new offices of Ukrainian companies have been opened abroad. And some were closed in Ukraine.

*According to DOU analytics – winter 2023 results

Four offices of game development companies offices shifted to Poland (Plarium, Volmi, N-ix, Five Systems Development).

Companies also chose Romania (Room8, Five Systems Development), Montenegro (G5, Playrix), Czech Republic (GSC), Bulgaria (G5), Spain (Room8), Portugal (Playrix), Kazakhstan (G5), Georgia (G5), Armenia (G5), Cyprus (G5) and Colombia (N-iX Game & VR Studio).

Only two offices were opened in Ukraine during this period – in Kyiv (Pingle) and Vinnytsia (N-iX Game & VR Studio).

iLogos Game Studios, Bini Games and G5 Entertainment closed their offices in Kharkiv. And Whaleapp LTD closed its office in Kyiv.

- The number of gaming industry specialists began to decline rapidly.

A significant portion of companies attributed this negative trend to the relocation of their specialists to other international locations. For instance, Ubisoft successfully transferred its employees to studios in Canada, Sweden, Germany, and France, among others. Similarly, GSC Game World moved more than 50% of its workforce to Prague, where they remained with the company but ceased paying taxes in Ukraine.

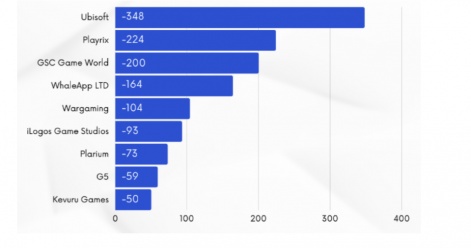

Among the companies experiencing the most significant loss of specialists in Ukraine, Ubisoft stands out, with a total decrease of 348 employees in the country.

- International and foreign companies are returning to hiring Ukrainians.

Winter showed that the Ukrainian market can work even in conditions of war and blackouts.

“Continuing or starting any type of business in the Ukrainian game development industry is not a risky endeavour. Despite the challenges, our industry is not only operational but also growing. At present, Ukrainian professionals are exceptionally well-prepared to handle unexpected circumstances and challenges, making it a safe and promising choice for entrepreneurs”. – Iryna S’omka, Director of Business Development/ Partner, Games Gathering

- Certain Ukrainian companies have seen a rise in their profits.

Nordcurrent studio, which has offices in Ukraine (Odesa and Dnipro, now relocated to Warsaw), reported a significant 42% increase in revenue for 2022. The most recent data shows that the company’s revenue has reached 89 million euros. Despite the mobile game market challenges, the company has grown primarily through successful new game launches and effective promotion of its existing projects. Nordcurrent specialises in developing casual games for mobile devices and PCs.

According to Steam, the Ukrainian language now ranks 16th among the most popular languages on the platform. The percentage of Steam users with a Ukrainian interface has increased from 0.43% to 0.5%. Before the full-scale invasion, it was at 0.16%. In 2022, Steam introduced 405 games with Ukrainian support; in 2023, there were 60 games with Ukrainian localisation featuring demo versions of upcoming games.

Investments do exist in 2023:

- The American games company Mythical Games, a resident of Diya.City, successfully secured a $37 million investment. In January of this year, it acquired the Ukrainian startup DMarket, thus establishing an office in Kyiv. Mythical Games specialises in blockchain gaming and Web 3.0 projects. In 2023, Mythical Games expanded its portfolio by acquiring the Ukrainian marketplace for trading virtual items and game skins, DMarket.

- During the war, Jarvi Games stood out as the sole company to complete a substantial public deal, raising $3 million in a second investment round.

- A major international company headquartered in the USA, recently acquired for $4.9 billion, invested $40-45 million in a Ukrainian studio with a free-to-play FPS project.

- Additionally, there were two unannounced pre-seed rounds, each totalling up to $1 million.

What Happened To The Ukrainian Labor Market:

*According to Djinni analytics Q1, Q2 2023

“Overall, the recession continues worldwide, and the Ukrainian market is not an exception, but at the same time, AAA developers continue to work on their promising titles and keep hiring top-notch professionals. Outsourcing companies still attract new clients and projects, which means that the hirings will go on and the industry will keep developing. Investments also came back to Ukraine, so we feel quite positive about the future of the Ukrainian games industry. We believe the crisis is not forever, and we will see more positive news soon”. – Sasha Kononenko, Recruitment Lead and Partner, Values Value.

In-demand and vulnerable professions:

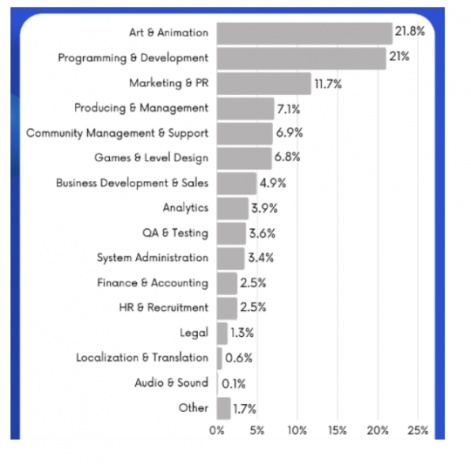

As recruitment agency Values Value reported, currently, the most in-demand fields in companies are Art and animation (+21.8%), Programming and development (+21%), Marketing & PR (+11.7%), Producing and management (+7.1%), Communication Management & Support (+6.9%).

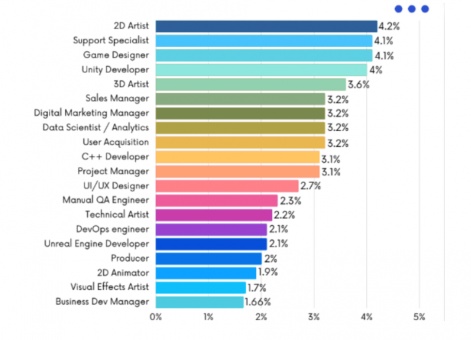

Among the TOP 5 most wanted specialists are:

- 2D artists

- Support specialists

- Game designer

- Unity developer

- 3D artists

Interestingly, Unity programmers are sought in Ukraine by 47% more than UE.

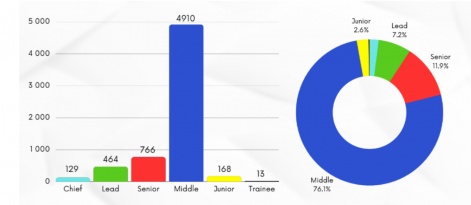

Number of vacancies at various levels in the first half of 2023

(*based on analysis from ingamejob.com and other sources)

Due to recent layoffs, the labour market is currently abundant with highly skilled professionals. Senior-level experts who were made redundant are now actively seeking employment and are even considering mid-level positions that offer lower salaries but are better than having no job at all. This trend is evident in the data, where companies attempt to reduce costs by posting mid-level positions that seniors can readily apply for.

Salaries And Income Satisfaction:

*Big Games Industry Employment Survey 2023

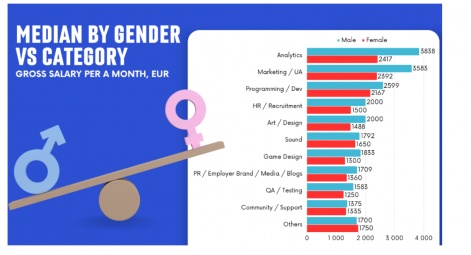

The gender pay gap is always a topic to discuss. This year is no exception. Currently, men in the Ukrainian games industry earn an average of €2,315 (before tax), while women earn €1,544 monthly.

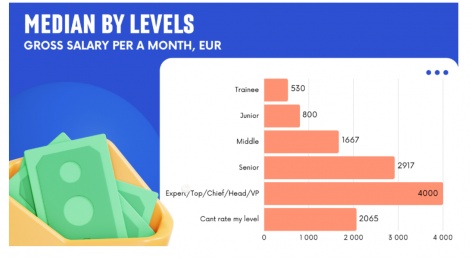

If we take into account the level of experience of game dev specialists, then their median gross monthly income will be as follows:

- Trainee – 530 euros

- Junior – 800 euros

- Middle – 1667 euros

- Senior – 2917 euros

- Expert/Top/Chief/Head/VP – 4,000 euros

The Ukrainian games industry is navigating a challenging landscape in 2023. While it faces various obstacles, there are also positive indicators of resilience and growth. The industry continues to adapt to the evolving global landscape, offering opportunities and challenges for professionals across different disciplines.

Edited by Paige Cook

Based on materials: Big Games Industry Employment Survey 2023, market research based on the InGame Job portal, internal statistics of Values Value, and other public sources (DOU, Djinni, etc.).