Aaron M. Sprecher via AP.

As Newsmax hurtles towards two major defamation trials over its coverage of the last presidential election, the conservative cable news network is pinning its hopes of survival on an audacious plan to go public.

Newsmax announced a bid last week to raise $225 million from investors in anticipation of an IPO later this year or early next. It’s offering 30,000 shares at $5,000 each to accredited investors in an apparent attempt to mimic the success of Donald Trump’s Truth Social, a media company that, despite steep financial losses, has boomed thanks in no small part to retail investors looking to give the former president a boost.

“Now more than ever, especially in this election year of 2024, America needs Newsmax and you can join with us as an investor,” Newsmax CEO Chris Ruddy said in a press release.

Newsmax is promoting the IPO aggressively. On Saturday, Newsmax host Lidia Curanaj abruptly ended an interview with former U.S. Ambassador to Germany Ric Grenell in order to plug the public offering.

“We want you to be a co-owner,” the host told viewers.

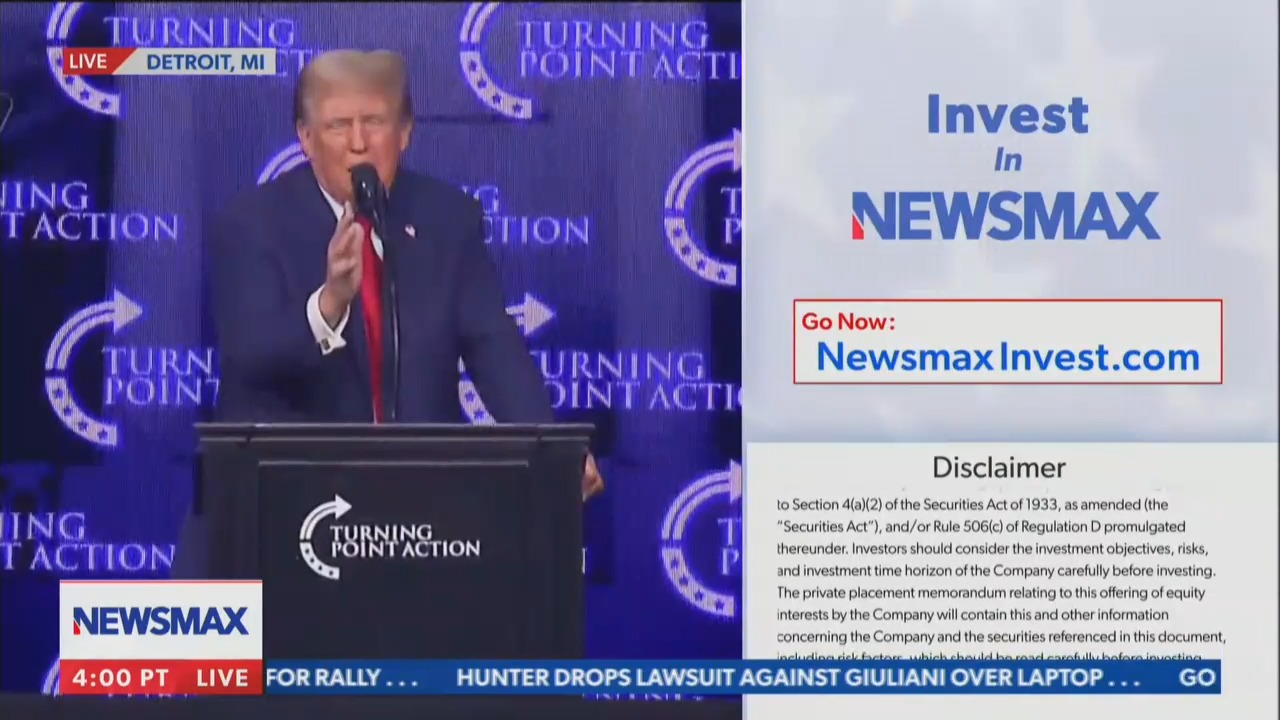

During Trump’s speech at a TPUSA conference in Detroit, which Newsmax aired in full, the IPO was promoted with a large graphic on screen.

Sources who spoke with Mediaite described the public offering as an effort to stave off financial ruin as the network faces two potentially fatal defamation lawsuits from election tech companies Smartmatic and Dominion. Both allege Newsmax promoted false claims the election was stolen from Trump in a bid to lure viewers and juice profits. Newsmax has denied those claims.

“It appears Newsmax is trying a Hail Mary pass to secure a financial lifeline with low info investors since legitimate funding sources will likely run from this,” said one Newsmax insider with knowledge of the company’s finances.

In a 225-page disclosure to potential investors, Newsmax stated the company is “currently involved in significant litigation, including claims relating to alleged libel or defamation and personal injury and property damage, free speech, and regulatory requirements.”

On page 72 of the document, Newsmax disclosed that it is being sued by Dominion, which is seeking upwards of $1.6 billion in damages, as well as Smartmatic. Newsmax also revealed in the document that in 2023, the company settled with an unidentified commercial party for $41.3 million, to which it has paid roughly $2 million so far.

The disclosure said the network’s revenue last year was $135.3 million. The company hasn’t made a profit since 2021, having lost $20 million in 2022 and $41.8 million in 2023.

A Newsmax spokesman did not dispute those losses in a statement, but claimed the company is currently in the black: “Newsmax is profitable and expects to end the year as such while Mediaite is run by a host from a competitor network, which explains the fiction and spin it regularly provides about Newsmax.” (Dan Abrams, the founder of Mediaite who hosts a show at NewsNation, had nothing to do with the conception or execution of this story.)

“All businesses need capital to survive,” wealth manager and financial analyst Ted Jenkin said in an interview with Mediaite. “With its ongoing legal challenges financially and the need to grow the top line revenue, this is the main reason Newsmax is going to a crowdfunding model.”

He added: “This won’t solve the legal challenges that Newsmax or any media outlet faces, but it will potentially give them the necessary capital to deal with that financially while they continue to expand their footprint in their target demographics.”

Indeed, if Newsmax is able to raise money from the public offering and survive the legal challenges, it could emerge from the turmoil as an enduring force in the conservative media ecosystem. The network, which has been on air for a decade, established itself in the last few years as an influential platform favored by supporters of Trump.

The stakes are high for Newsmax. In the Smartmatic and Dominion cases, which are slated to go to trial this year, it faces similar charges to those leveled against Fox News, which reached a settlement with Dominion to the tune of $787.5 million. Fox’s Smartmatic case is ongoing.

One Newsmax insider who spoke with Mediaite scoffed when asked if the network could stomach a payout anywhere close to what Fox had to pay Dominion. “They can’t even afford a $15 million settlement,” the source said.

“If it’s 20 million or above they probably wouldn’t be able to settle,” estimated another source, who added the network has been operating on a shoe-string budget for the last few years. “They’re on a massively tight budget.”

“We’ve got a 12-year-old switchboard in the control room,” they added. “It shuts down two or three times a week. They need to spend a couple million dollars on equipment. They’re not doing it. And there’s a fucking reason. I think that [Ruddy is] worried about an existential threat at the company if he has to settle one of these lawsuits.”

One Newsmax staffer told Mediaite the IPO “feels incredibly shady amid the mountain of legal trouble Newsmax is facing, in addition to the chaos and incompetency behind the scenes.”

“Staff has heard repeatedly in recent months about the company budget being tight,” they said. “Newsmax scales back on important events and can’t even afford quality equipment in the studios. What the company currently has is outdated and constantly breaking down.”

The staffer also expressed outrage that hosts on the network have been made to promote the IPO on the air.

“It’s an embarrassment to watch as all talent is forced to read what is essentially an infomercial, pushing shares on viewers in middle America who probably can’t afford the inevitable losses especially in this economy,” they said. “It seems like they are looking for a cushion if/when all goes south with the lawsuits.”

The bid has been compared both internally and by outside analysts to how Trump has sought to raise billions from his supporters by taking Truth Social – which lost a staggering $327.6 million in the first quarter of 2024 – public as a kind of MAGA meme stock. The former president faces costly legal threats of his own.

“If they were making a lot of money they wouldn’t be doing this,” said one Newsmax insider. “Hopefully, Newsmax gives you a baseball cap with your $5K share purchase because at least you’ll be able to sell your baseball cap.”

Have a tip we should know? tips@mediaite.com