I’ve seen a few statements after the CPI numbers came out this morning that I’m fairly certain were written last night. Almost like Mad Libs with the numbers filled in. The commentaries all indicate that inflation numbers are still high.

Yet when I spoke with Gisela Hoxha, a Citi US economist, she sounded upbeat about the numbers. In particular, core inflation was much softer than expected.

Hoxha noted that as inflation started coming down over the last year, disinflation was mostly seen in the prices of goods, while services continued to be stubbornly high.

That changed a bit with today’s numbers, with slowing in some of the more sticky service components of CPI. “This trend actually showed that some of the services components were softer, like auto insurance, personal services,” Hoxha said.

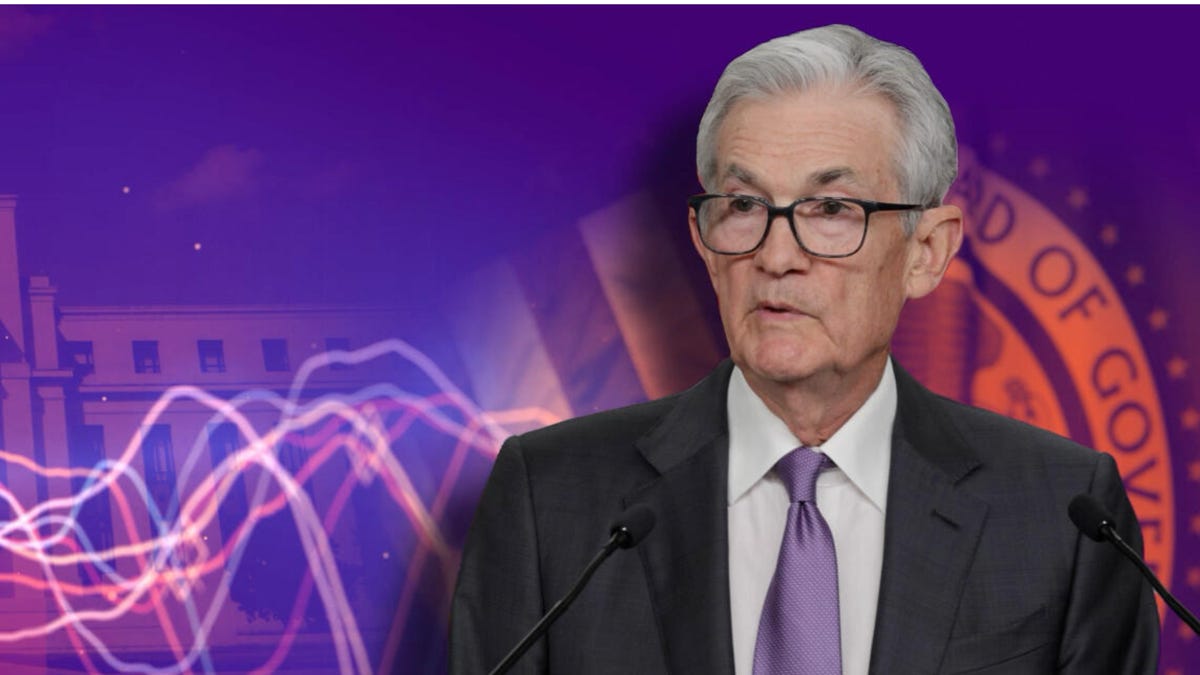

Though the shelter index continues to remain high — up 0.4% month over month, yet again — these softer numbers could put Fed Chair Jerome Powell in a better mood at today’s press conference following the Federal Open Market Committee meeting.

Hoxha also noted that we’re expecting more data, including labor market numbers, to be released before the next Fed meeting in late July. Citi predicts the Fed will cut interest rates three times this year, in September, November and December. But there is certainly some probability for July, she said.

We’ll keep you in the loop as we talk to more of the experts.