If there’s one thing you can count on in this industry, it’s that big technology companies don’t understand games and don’t have the patience for it.

What’s more, almost anytime one of these large firms steps into games, it’s completely ancillary to its core business. Time and again these companies make the same mistakes, wasting billions of dollars without any real long-term vision or plan – just an eye on huge investment and short-term gains.

But who are they kidding anymore?

Crunch time

Last week, Bloomberg and Reuters reported that TikTok owner Bytedance is closing its publishing arm Nuverse and significantly scaling back its plans for games.

The company made a big splash just a few short years ago, buying Mobile Legends developer Moonton Technologies for some $4 billion, and publishing numerous games under the Nuverse publishing label, including Second Dinner’s CCG Marvel Snap.

It also also set up casual and hypercasual games developer Ohayoo (though that too saw 100 layoffs in 2021).

Despite heavy investment in the games industry, it’s all change now. Reuters reported that ByteDance will now tell staff to halt work on unreleased titles by December and will “look for ways to divest from titles already launched”. The report noted the decision is likely to result in hundreds of job losses.

“We regularly review our businesses and make adjustments to center on long-term strategic growth areas,” a spokesperson said. “Following a recent review, we’ve made the difficult decision to restructure our gaming business.”

So why pull back now, billions of dollars later?

Big tech graveyard

To quote a famous sci-fi TV show: all of this has happened before, and all of this will happen again. Big tech companies often make the foray into games in the hope of large short-term games. It almost never works, as games are often never a core part of their business, and this industry requires long-term thinking, patience and experienced teams with real knowledge of the sector.

Big tech companies often make the foray into games in the hope of large short-term games. It almost never works.

Sony and Microsoft’s success in games has been a long, hard fought road, and both have stumbled along the way – particularly the latter in more recent generations.

Social apps like Snap and Facebook all tried to get in on the instant games trend a few years ago. Working with a few key partners – Zynga perhaps among the most notable of these – they saw games as a new way to engage users. After all, these social and entertainment apps are fighting over your time, as much as your money.

Facebook’s efforts proved particularly messy. It initially wanted a 30% share from developers, while also having to adhere to Apple and Google’s own 30% cut, leaving studios out to dry with a 49% cut on mobile. It reversed this decision, wiping out its own royalties – likely one of the death knell’s for the Instant Games platform’s for hopes of monetisation. The service was later pulled from Messenger, and seems to have died a quiet death. Zynga wasn’t particularly impressed with Facebook’s “starts and stops” at the time.

Let’s not forget, Facebook also shut down its Twitch-wannabe rival Facebook Gaming in 2022, not long after signing some big exclusivity deals with influencers. And, of course, Facebook went from having one of the largest games platforms back in Zynga’s heyday to then pivoting its business toward ads and forgetting about its monetisation system, Facebook Credits, and consequently games, entirely. It had bigger fish to fry. Zynga suffered the consequences of its reliance on a big tech company for years after – and never actually recovered its peak share value from its IPO.

Snap, meanwhile, dumped its games business into “maintenance mode” and “substantially reduced investment” in the division as it focused on its core, flagging business. When games is not a core function, showing little growth and not monetising, it’s the obvious area to cut.

One of the lessons here was that mass, highly engaged audiences aren’t necessarily interested in playing games on that same platform – that’s not what they are there for. (A larger Western issue, not withstanding WeChat’s popularity in China). These endeavours also require continued patience, expertise and investment to make them work, if they can at all. A lesson for Netflix’s current gaming ambitions – with less than 1% of subscribers playing its titles daily – and TikTok if it takes instant games seriously.

Amazon’s foray into games has been a disaster to date. It bought the rights to the CryEngine tech for its own engine Lumberyard – used in New World, and that’s about it. A string of high profile hires in the early days failed to produce any successful games.

Mass, highly engaged audiences aren’t necessarily interested in playing games on that same platform – that’s not what they are there for.

More recently, the company has had mixed success with publishing titles like the internally developed New World and externally-built Lost Ark, but it has also had high profile failures like the cancelled free-to-play studio Crucible. This is surely hardly the future the company had envisioned.

Google, meanwhile, never quite got off the ground with its streaming platform Stadia. Headed up by Phil Harrison, the concept never caught fire with the public. Google also seemed to be in a rush to launch it. It announced the platform less than a year out from release, and at the same time formed its own internal development team Stadia Games and Entertainment, led by Jade Raymond. Given how long games take to make – and with nothing to show upon reveal – it was clear from the start these internal titles would never get released. And they didn’t.

Stadia was eventually shut down, having quickly become another Google business to languish within the enormous corporate structure without much direction, investment or bother. Amazon, to its credit, remains somewhat patient with games, but for how much longer?

Mobile’s dramatic growth story is over

The games industry struggled during the past two years to continue its growth story, experiencing a comedown from the pandemic-induced highs. This period ultimately led to unsustainable M&A and expansion for many companies, which are now scaling back en masse. This has been compounded by poor macroeconomic conditions.

On mobile though, and perhaps more directly linked to ByteDance’s retreat from games, is Apple’s decision to enact privacy changes with app tracking transparency (ATT). This effectively destroyed the foundations the industry has been built upon, the ability to acquire users most likely to be interested in your game. China’s crackdown on games and tech may also be a factor at play.

The mobile games market is now in decline and has arguably even become hostile to the publishers working in it – the ones that earn Apple and Google significant money from their highly profitable app stores. Playtika even previously announced it would not be launching new titles until current mobile marketing conditions changed (though arguably the company wasn’t big on new releases anyway).

With such a tough market for its publishing division, it’s no real wonder why ByteDance is pulling back, even billions of dollars later.

And once again – games is not core to its business. For a big tech company like ByteDance, without the patience and a lack of rapid growth, the sector is perhaps not worth such big investment outside of its main money maker TikTok. Particularly as the company runs towards an eventual IPO.

ByteDance’s mobile performance

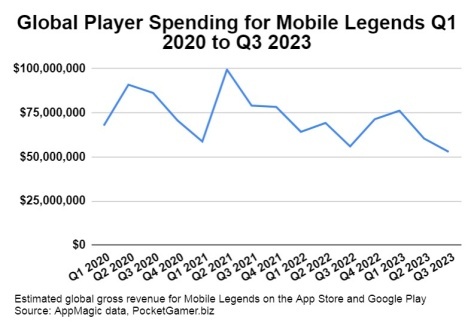

AppMagic data shows a serious decline for ByteDance’s games business. After acquiring Moonton Technology for $4 billion in 2021, its flagship game Mobile Legends has experienced a steep decline. That same year, the title hit peak revenue, generating $315.8 million in gross player spending worldwide across the App Store and Google Play. In 2022, meanwhile, the title accumulated $261 million, a fall of 17.4% year-over-year. Estimates so far this year put the title at approximately $240 million.

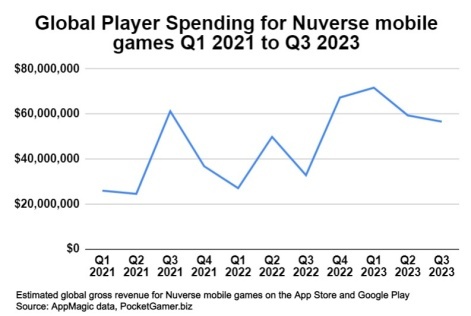

Nuverse, meanwhile, is lacking major and sustainable hits. Its most significant launches have been Ragnarok X: Next Generation, which has generated $222.7 million since its October 2020 release – with revenue down significantly since then, and Second Dinner’s Marvel Snap, which is estimated to have accumulated $184.6 million in gross revenue on the App Store and Google Play.

Given ByteDance’s ambitions of competing with heavyweights like Tencent and NetEase, its publishing business hadn’t exactly set the world alight with repeat successes.

TikTok focus

It’s not completely game over for ByteDance’s gaming ambitions. It’s been busy building a games ecosystem within TikTok.

At the start of the year, it began testing instant games in the UK, with familiar names like FRVR and Voodoo developing titles for the platform. While the company said it has no plans to become a games platform – I guess we’ll see – it’s already becoming a key marketing platform for publishers and a hub for content creators to share gaming videos and clips.

ByteDance’s retreat from games is at once a shock and completely unsurprising. It’s not the first big tech company to invest heavily and then pull the plug suddenly and dramatically a few years later when it has its eyes on a bigger prize, one more central to its core business.

When it comes to big tech: All of this has happened before and all of this will happen again.