The following content is sponsored by American Commitment.

Today’s constant evolution of technology has made us increasingly dependent on digital platforms and services for the simplest of tasks. While the convenience is undeniable, it also forces Americans to be more vigilant about protecting their personal information and private data from the plethora of bad actors in the world.

Recently, Live Nation, the parent company of Ticketmaster – the go-to platform for purchasing event tickets – disclosed a significant data breach where hackers threatened to sell millions of Ticketmaster users’ names, addresses, phone numbers, and credit card information on the dark web.

Retailers like Ticketmaster regularly fall victim to cyberattacks, data breaches, malware attacks, and much more. It’s estimated that 780,000 data records are lost to breaches and hacking efforts daily.

When most Americans see an unfamiliar and unauthorized charge on their credit card statement, they typically contact their bank right away. That’s because we trust and depend on our financial institutions to protect sensitive information.

Most Americans choose credit cards over other forms of payment as they feel they are more secure. A report from PYMNTS Intelligence found that 80 percent of cardholders use credit cards because they prioritize transaction safety and data security more than any other payment method.

Banks and credit unions invest billions of dollars in data security systems and operate under strict data security compliance requirements to protect cardholders’ confidential information.

We often take for granted the robust payment processes in place when we swipe our credit cards or make online purchases. This extensive global financial system ensures secure, reliable, and efficient electronic payments for everyday transactions such as buying groceries or fueling up at the gas pump.

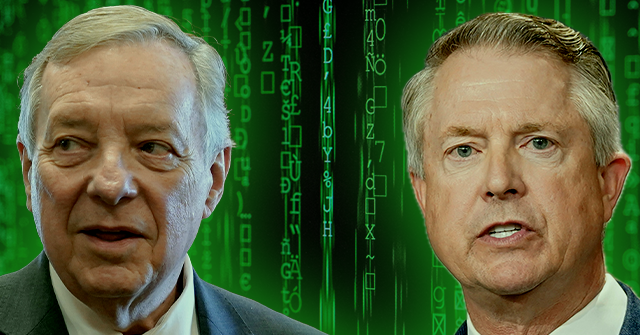

Senators Dick Durbin (D-IL) and Roger Marshall (R-KS) have introduced credit card legislation that threatens the stability and security of credit card payments, putting cardholders’ personal data in jeopardy. The bill will alter the current system of payment routing, allowing retailers — without the customer’s permission — to process credit card transactions through off-brand, cut-rate networks instead of Visa and MasterCard.

With increased threats of cyberattacks and data breaches every day, the last thing Americans need is another concern surrounding their data privacy. Credit cards are already more vulnerable than debit cards, as they act as an unsecured loan from banks. The Durbin-Marshall bill will only further these vulnerabilities for cardholders worldwide.

If corporate giants like Walmart, Home Depot, and Target persuade Congress to pass the Durbin-Marshall legislation, they will reduce their costs by shortchanging data security. That likely means an increase in data breaches that will hurt American consumers, small businesses, and community banks by allowing your credit card transactions to run on untested networks that might not have the same protections put in place by America’s leading financial institutions.

Congress should reject the Durbin-Marshall bill and focus on protecting the personal data of all Americans.