The president called on Congress to act, but he could enact a rent stabilization policy with a stroke of his pen. Tenant leaders say they will keep organizing until it happens.

In the midst of his do-or-die NATO summit press conference, President Joe Biden shocked landlords and tenants alike with a sudden proclamation: “If I’m reelected, we’re going to make sure…corporate rents for apartments [and homes] are limited to 5 percent.” At a campaign rally in Las Vegas a few days later, he made it official by unveiling a historic rent stabilization plan. The policy, which needs congressional approval, requires landlords owning more than 50 units to restrict annual rent increases to 5 percent or less if they want to utilize a popular Trump-era tax write-off. The Biden administration estimates that at least 20 million of the nation’s more than 40 million rental units would be covered by the proposal.

“It was absolutely monumental for the president to make the move for rent caps,” Hell Woods, a tenant living in Kansas City, Missouri, told me as they waited for exterminators scheduled to arrive at their apartment later that day.

“I know it was because of us,” said Woods. “But it’s not real until it’s real.”

Current Issue

These were just words, explained Woods, particularly given the fact that they were said just one week before Biden ultimately dropped out of the 2024 presidential race and endorsed Vice President Kamala Harris to take his place. So while Biden’s proposal is undoubtedly a major rhetorical victory, Woods and other leaders representing a yearslong national tenant-led campaign say there is still much work to do to move rent caps from laughable to essential policy in Washington.

Their call is clear: even with just five months left in the White House, Biden could move to protect tenants today. He just has to choose to act.

When Woods moved into Quality Hill Towers in November 2022, they said their apartment was “completely broken.” Bedbugs ran amok. In their first year at the complex, they said they saw everything from gas leaks to asbestos to broken heaters.

The following year, their landlord increased their rent by nearly 15 percent, from roughly $600 to $700 a month. Woods, a 25-year-old who makes $12 an hour working at a hotel, was distraught.

Woods is one of millions. From 2019 to 2023, rents jumped more than 30 percent. One federal study from 2020 found that every $100 increase in median rent was associated with a 9 percent increase in homelessness. And with wage increases lagging, the effects of these increases on tenants who are able to stay in their homes are still often immediate and severe.

“We cut back on food, we cut back on medicine, on literally anything,” Woods said. “All it’s doing is putting us out in the streets.”

Eventually, Woods sought out KC Tenants, a local member union of the national Tenant Union Federation (TUF), formerly known as Homes Guarantee, for help. Comprising building-wide, citywide, and statewide unions of tenants from Montana to Kentucky to Connecticut, TUF had previously spearheaded a campaign to enact a wide slate of tenant protections, many of which the White House adopted in January 2023 with its “Blueprint for a Renters Bill of Rights.”

But by the time Woods got in touch with the campaign, these tenant organizers had already set their sights on a loftier policy goal: a rent stabilization policy that the Biden administration could enact with the stroke of a pen.

-

How Freddie Mac Helps Private Equity Profit From Tenant Misery

Their effort hinges on the Federal Housing Finance Authority (FHFA), the agency charged with regulating the government’s gargantuan mortgage providers, Fannie Mae and Freddie Mac. Corporate landlords receive billions in annual financing assistance from Fannie and Freddie, and many of these landlords have come to rely on this assistance as an expectation of doing business. In fact, as Eileen Markey reported for The Nation last year, Fannie and Freddie have allowed landlords en masse to overleverage the loans they take out to buy rental properties like Woods’s, loans stretched so thin that rent must always be raised and maintenance expenses must always be cut.

“Their businesses rely on tenants’ instability,” Tara Raghuveer, director of TUF, said. “Their business model only makes sense in a world where they count on regular and excessive rent hikes and evictions.”

As tenant leaders were hearing stories like Woods’s with alarming frequency, the campaign, which has included dozens of lawyers and economists throughout, settled on a proposal that could help course correct Freddie and Fannie away from the crisis they’ve helped to produce. As tenant leaders wrote in a memo to Representative Alexandria Ocasio-Cortez earlier this year, “President Biden can direct the Federal Housing Finance Agency to require an annual limit of 3% on rent increases” in Fannie and Freddie-backed properties. Biden could do this today, via executive order, and would instantly provide relief to nearly 15 million households living in one of these properties.

The question for the campaign then became how to convince the president to go for it.

In September 2021, TUF assembled its first “tenant delegation,” bringing renters like Woods together with legislators, advisers, think tanks, and other DC movers and shakers, including FHFA director Sandra Thompson. Raghuveer said that, due to the pandemic, many of these meetings were likely the first time in nearly two years these officials were speaking with “normal people” face to face.

But it wasn’t until January 2023, when Congress members, led by Representative Jamaal Bowman and Senator Elizabeth Warren, sent a letter to Biden urging the president to direct the FHFA to enact “anti-price gouging protections” to “hold landlords accountable,” that the campaign began to feel a sudden surge in momentum. In total, 43 members of the House and seven members of the Senate signed on, as legislators began to have what the campaign’s organizers described as “light bulb moments” in their meetings with tenants.

In July, just six months later, a new letter from Congress demonstrated the campaign’s continued progress. Not only had the senators signed on more than doubled to 17, but the language was much more explicit; this time, lawmakers demanded that the FHFA set “limits against egregious rent hikes in properties with financing backed by Fannie Mae and Freddie Mac.” The letter even referenced TUF’s tenant delegations as an influence on their decision-making process.

By August, Raghuveer saw the campaign creating a “new common sense,” as top party leaders like Representative Maxine Waters, ranking member of the House Financial Services Committee, began advocating for “an end to unfair and exorbitant rent hikes” at FHFA properties. Senate majority leader Chuck Schumer signed on too.

At the same time, officials at the FHFA sent out a “Request for Input” on the campaign’s proposed protections, including rent caps, providing an opportunity to bring more tenants into the advocacy process by submitting feedback. They received well over 2,300 expressions of support from tenants—a historic level of engagement, particularly given that typical RFIs yield less than 100 responses.

In November, TUF sent its most recent tenant delegation to DC, including Woods, whose apartment is FHFA-backed. They met with FHFA director Thompson, among many others. The delegation left DC feeling surprised at “how little the people in government and the people in these big power positions know about day-to-day life in their own country,” Woods said. To that end, Thompson later personally visited Woods and other TUF leaders’ complexes across the country to hear from tenants directly about ways the FHFA could potentially intervene.

“We live this day in and day out,” said Elizabeth Olvera Perez, a tenant and leader in the Louisville Tenants Union who joined Woods on the delegation to DC. “[Lawmakers] need to talk to us, because we’re the ones who know.” Olvera Perez said she and her parents all live in a FHFA-backed trailer park. In the last year alone, she said her landlord has hiked her parents’ rent by close to 20 percent, even though prior to the increase they already had no extra money.

That a tenant-led campaign has moved lawmakers at all, Raghuveer said, already represents a paradigm shift. “Decision-makers are very happy to have tenants welcomed into meetings when they’re telling a story about pain, but not welcomed when they’re bringing prescriptions about policy,” she said. But experience informs their prescriptions: The increases both Olvera Perez’s family and Woods fell victim to would have been impossible under the proposal they now champion.

Such proposals are popular, too, as recent polling shows that three-quarters of registered voters in five swing states (Nevada, Arizona, Michigan, Pennsylvania, and North Carolina) report that housing costs cause the most stress in their families, ahead of other economic issues.

More crucially, the poll also found that 70 percent of these voters, including 79 percent of Black voters, reported they were more likely to vote for a candidate who supports rent stabilization. The majority of respondents also preferred progressive language (“we need to limit rent hikes”) over moderate (“rent caps just make it harder for developers to build enough housing”) or conservative (“housing costs are rising because [of] the influx of illegal migrants”) language.

These findings suggest that the expanding cohort of rent-cap supporters in government are merely catching up to where voters, especially tenant voters, have already been.

Biden’s pronouncement for a rent cap in July is an important step forward in TUF’s push for action on behalf of the tenants it represents, but critics of the policy argue that beneath the rhetoric is a plan critically weakened by appealing to the real estate lobby. For example, the caps would last only three years, leaving the door open for corporate landlords to make up for lost time once the rent hike moratorium ends, as they did when the Covid-era eviction moratorium ended. New construction is also exempt from the policy, in an effort to incentivize housing development amid widespread shortages of affordable rentals. But this exemption means the Biden administration is simultaneously saying these rent regulations are vital while insisting that part of the solution to the housing crisis is a massive influx of properties those same regulations will not apply to.

By far the biggest weakness in the policy though, Raghuveer and the tenants interviewed say, is its reliance on congressional approval in a currently Republican-controlled House, with no guarantee of a Democratic trifecta on the horizon.

“We got the president to say ‘rent cap,’” Raghuveer said. “But that does not materially change the life of any of these people who have been organizing for real relief for years. It’s not a material outcome, right? Congress is not going to act on this anytime soon.”

Olvera Perez puts it a little more bluntly: “The whole fact that [Biden] went to Congress to deal with it is messed up.”

With Vice President Harris now hitting the campaign trail, she has yet to clarify which, if any, of Biden’s recently proposed policies she too will seek to implement, though she did applaud the plan when it was announced. But at least for the next five months, Biden will still be the one with the authority to act.

And as Thomas Silverstein, a housing attorney and visiting lecturer at Yale Law School who has served as an adviser to TUF’s campaigns since 2019, emphasized, Biden can pass rent stabilization without Congress. He explained that the FHFA, as a regulatory body, has extensive flexibility to place conditions on federally-backed mortgages that is already baked into existing statutes. It is “very settled and noncontroversial,” Silverstein said.

Popular

“swipe left below to view more authors”Swipe →

The Biden administration understands this, given that part of the rollout includes several new FHFA regulations that will go into effect via the same mechanism TUF has been advocating Biden to use for rent stabilization. For example, for all “future loans acquired by Fannie Mae and Freddie Mac,” landlords now must give 30-day notices before rent increases and lease expirations, along with a five-day grace period before imposing late fees on rent payments. Rent caps just didn’t make the list.

“Clearly, the administration knows they do have the power,” Silverstein said.

The priority now, explained Raghuveer, is for advocates to use the momentum of the TUF campaign in lieu of stronger action from Biden to organize tenants to find the same power in their monthly rent checks as they do in a DC meeting room, as the former is a means to disrupt the American economy.

Accepting the capitulation inherent in Biden’s proposal, therefore, isn’t of interest to her.

“We were never going to win regulations from the federal government by asking nicely,” Raghuveer said. “That’s what a lot of the strategy in the last couple of years has been in the realm of, you know, asking nicely, storytelling, normalization. The next steps are going to require us pushing ourselves outside that ask nicely phase.”

But above all else, Woods’s urgency comes from the fact that, aside from the lingering bedbugs, their lease is up again in November. Where a new lease goes, a new hike will almost certainly follow. So the clock is ticking, and it’s only a matter of time before the increases compound to the point that Woods and their neighbors are forced to lose their homes.

So far, Biden is choosing to let the clock keep ticking.

“At the end of the day, it’s our lives on the line,” Woods said. “[Biden] could do it today. We’re waiting on him. But we’re only going to keep organizing until it happens.”

Thank you for reading The Nation

We hope you enjoyed the story you just read, just one of the many incisive, deeply-reported articles we publish daily. Now more than ever, we need fearless journalism that shifts the needle on important issues, uncovers malfeasance and corruption, and uplifts voices and perspectives that often go unheard in mainstream media.

Throughout this critical election year and a time of media austerity and renewed campus activism and rising labor organizing, independent journalism that gets to the heart of the matter is more critical than ever before. Donate right now and help us hold the powerful accountable, shine a light on issues that would otherwise be swept under the rug, and build a more just and equitable future.

For nearly 160 years, The Nation has stood for truth, justice, and moral clarity. As a reader-supported publication, we are not beholden to the whims of advertisers or a corporate owner. But it does take financial resources to report on stories that may take weeks or months to properly investigate, thoroughly edit and fact-check articles, and get our stories into the hands of readers.

Donate today and stand with us for a better future. Thank you for being a supporter of independent journalism.

More from The Nation

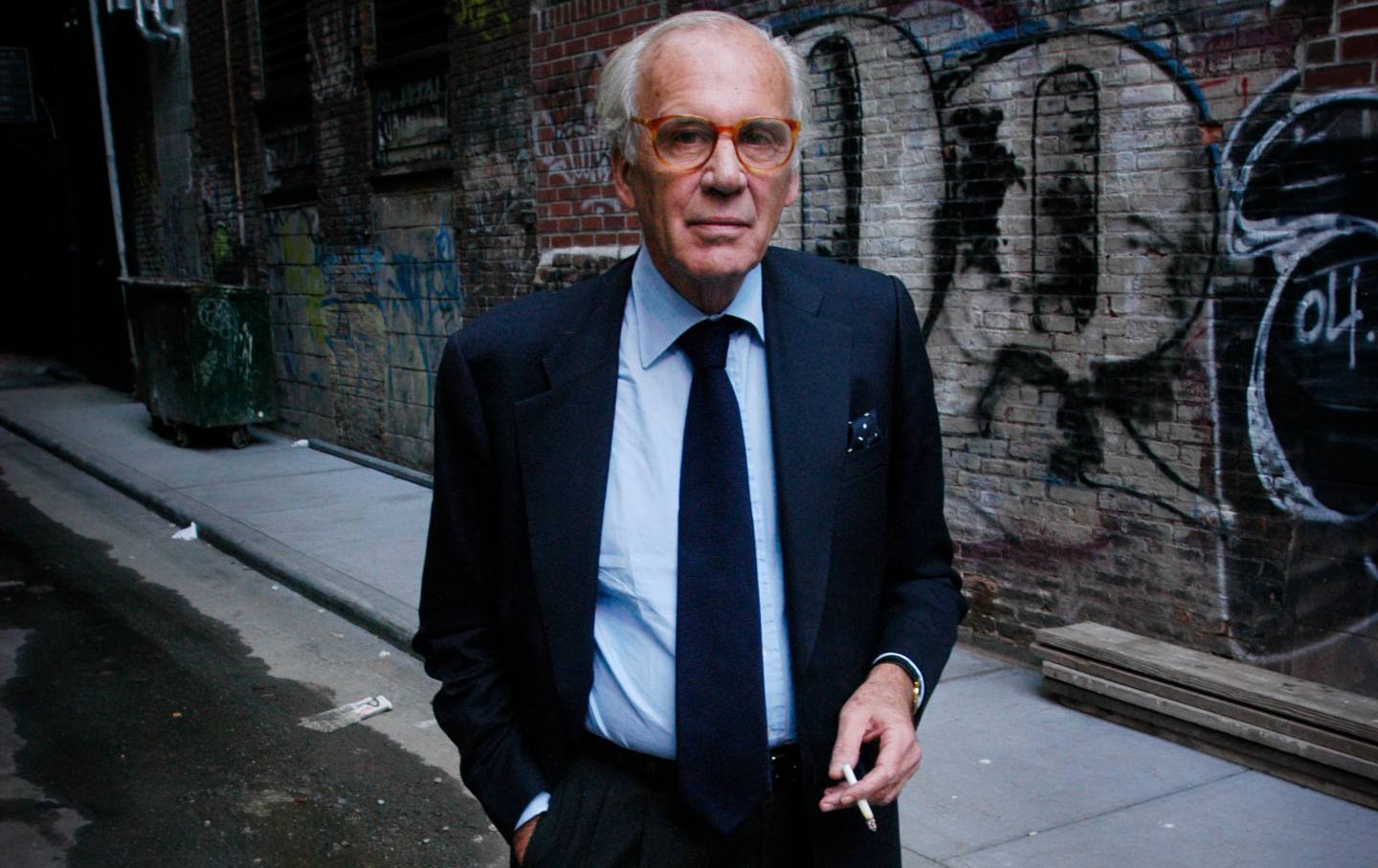

Writer Lewis H. Lapham, longtime editor of Harper’s Magazine and the founder of Lapham’s Quarterly, died in Rome. He was 89.

Obituary

/

Kelly Burdick

“The Olympic Games are profoundly disrupting the lives of French people,” the protesters wrote in a joint statement.“The question then arises: Who benefits from the Games?”

Dave Zirin and Jules Boykoff

There are at least two trans nonbinary athletes—Quinn and Nikki Hiltz—and they’re impossible not to cheer for.

Dave Zirin and Jules Boykoff

In the last year, an estimated 12,500 vulnerable Paris residents were forced from their homes.

Dave Zirin and Jules Boykoff

The administration has rebranded our library as a communal space for doing almost everything except reading.

StudentNation

/

Jeannine Chiang

Writer James Kilgore and information artist Vic Liu demonstrate the improvisations and ingenuities that allow incarcerated people to experience some small human comforts.

Visualization

/

James Kilgore and Vic Liu